Working capital loans and merchant cash advances differ in a few areas. So first, let’s start with the basics. A Merchant Cash Advance is usually taken out by businesses who have strong credit card sales, such as retail stores, restaurants and other service companies.

Most of the time, they either have bad credit or no credit. With a merchant cash advance, merchants are given a lump sum or cash advance from a lender. In turn, the lender collects a set percentage of the merchant’s daily credit card sales until the loan is payed off (the advance and premium). Terms usually are around 3-9 months.

Merchant Cash Advances are a great idea for certain types of businesses, however borrowers need to treat them just like a loan. Meaning, they should know exactly what percentage of credit cards sales they put forth each day and the total lump sum that they will have to repay after everything is said and done.

For most business owners, merchant cash advances are not the first option when it comes to business funding, but for many it’s the only way to receive funds. Some actually prefer this option because they are able to rest easy, knowing that the amount they pay per day fluctuates with their credit card sales, so they pay less during slower months.

For example, if the merchant agrees to pay 10% of their daily credit card sales, then they won’t have to worry about days when business is slower. Typically, merchant cash advancing companies usually take between 15-50% of daily credit card sales.

Business Loans on the other hand are similar in the fact that there is a daily payment, however the payment is a set and is deducted everyday, no matter what the businesses sales are. With a business loan, like a merchant cash advance, daily payments are taken because they have a lesser effect on cash flow. They are paid back in 3-18 months and are usually for a larger amount than a merchant cash advance. Another great feature of business loans is that a business is not required to accept credit cards.

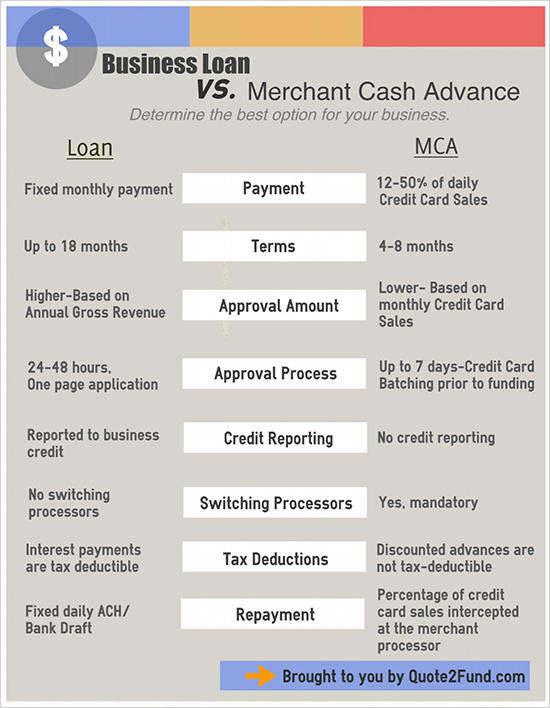

Now that you have information on each funding options, the next step is determining what’s best for you and your small business. Below is an Infographic that was created to compare the Merchant Cash Advance vs Business Loan.