What you see is what you get. Creating a culture of transparency in an industry known for fine print and hidden fees is no easy undertaking, but that’s exactly what we are doing. – Jules Dalsey, Founder

What this means:

- Transparent Rate – Disclosing an annualized interest rate or APR when applicable.

- No Hidden Fees – Disclosing all upfront and scheduled charges.

- Plain-English Terms – Describing all key terms in an easy-to-understand manner, including the loan amount, payment amount and frequency, collateral requirements, and the cost of prepayment.

- Clear Comparison – Presenting all of these pricing and other key terms clearly and prominently, in writing, to the borrower when the loan offer is summarized for the borrower and whenever a term sheet, offer summary, or equivalent is provided.

HOW RATES WORK

When you finance your business through Quote 2 Fund there are typically three elements that make-up your repayment:

Principal

The total amount of money borrowed.

Interest

The cost to borrow (may or may not include third party and/or origination fee).

Transaction Fee

Any third party or origination fees.

Principal

Interest

Transaction Fees

Things To Consider

With a variety of lenders and credit programs on our marketplace, pricing will vary. All rates are subject to individual credit and underwriting guidelines set by each bank or lender.

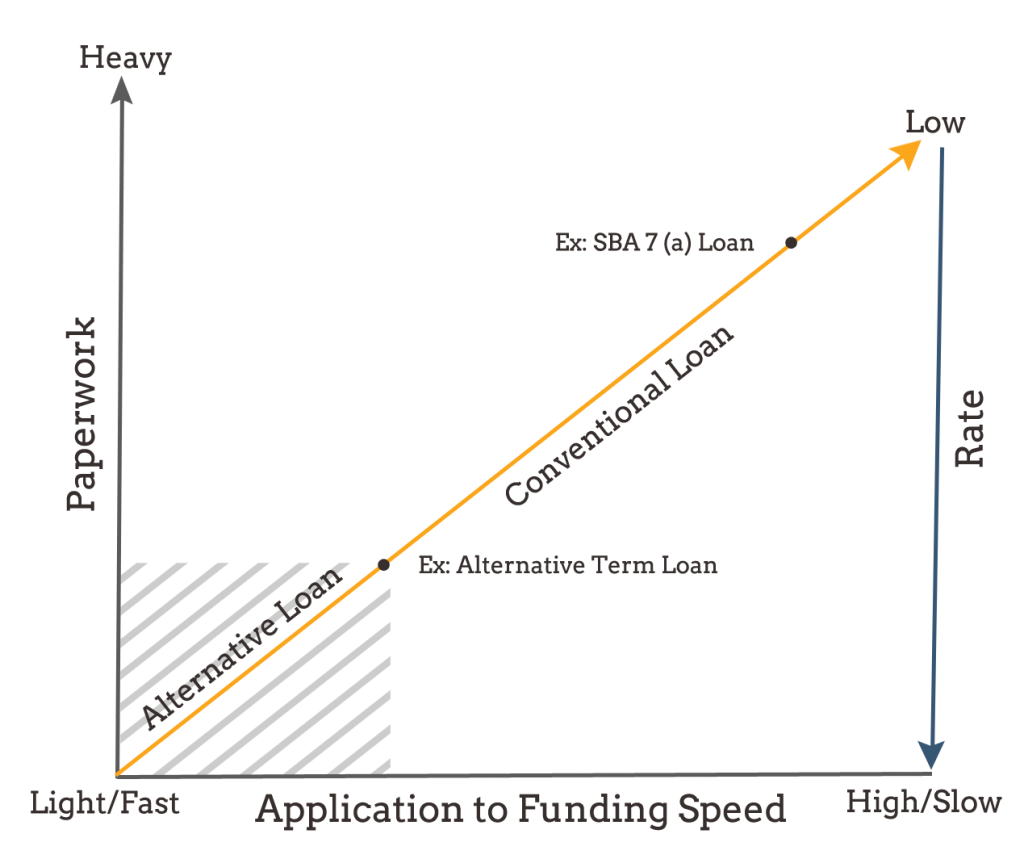

Generally, borrowers desire a low rate with a long term that’s quick to process and requires minimal paperwork. The adjacent graph illustrates the relationship between rate, term, paperwork required, and length of time to process and fund.

Typically, financing applicants will fall into one of three categories: Bankable, Non-Bankable, or Unqualified.

- Bankable clients are those who would likely qualify for conventional bank or SBA loans. They are more likely to qualify for a traditional, long-term, credit-based, secured financing product with a monthly repayment.

- Non-Bankable are those that would not likely qualify for conventional bank or SBA loans. They are more likely to qualify for an alternative, short-term, revenue-based, unsecured financing product with a fixed daily or weekly repayment. For these applicants, we work hard to meet their current financing needs while, guiding them to a state of future bankability (thus, qualifying for more desirable offers).

How we pay our employees and our bills

- Charge the lender a referral fee or 1-5% commission on total amount funded.

- Compensated for referral from an Origination Fee (typically 1-8% of the borrowed amount).